Best Credit Card Processors of 2025 | Side by Side Reviews

Choosing the best credit card processor is crucial for businesses aiming to provide secure and efficient payment options for their customers. A credit card processor facilitates transactions between customers and businesses by handling the authorization, processing, and settlement of payments, ensuring funds are securely transferred from the customer's bank to the merchant's account.

When selecting a credit card processor, consider factors such as cost and fees, security and fraud protection, and integration and compatibility with existing systems. Key players in the market like Square, PayPal, Stripe, Fiserv, and Adyen offer various features and benefits designed to enhance transaction efficiency and customer satisfaction.

Evaluating your business needs, including transaction types and sales volume, and comparing different processors based on fees, support, and security features will help you make an informed decision that supports your business growth and customer trust.

FEATURED SUPPLIERS

- Flat rate processing

- Rates as low as 2.75%

- Inventory Management

- Fast. Next day processing

OUR SCORE

9.8

![]()

Square

- No monthly or setup fees

- Rates as low as 2.4%

- Next-Day Deposits

- Easy setup

OUR SCORE

9.8

![]()

PayPal

- Online, phone, pay on the go.

- No startup costs

- Rates as low as 2.2%

- Customers pay direct from invoices

OUR SCORE

9.6

![]()

Yamaha

Factors to Consider When Choosing a Credit Card Processor

Factors to consider when choosing a credit card processor include:

- Cost and fees: Evaluate processing rates and additional charges.

- Security and fraud protection: Ensure compliance with industry standards.

- Integration and compatibility: Check alignment with existing payment systems.

Credit Card Processing and Payment Processing Statistics

Top 8 Credit Card Processors

Provider |

Key Features |

Rating |

Comments |

Link |

|

|---|---|---|---|---|---|

| 1 | Clover | – Affordable transaction fees – Round-the-clock customer support – Supports Apple Pay & Google Pay |

9.7 | Low Rates & No Hidden Fees —

Start Taking Payments with Clover® For As Little As $1/day with New Plans and Deals. |

COMPARE |

| 2 | Finix | – Ideal for high-volume businesses – Seamless developer-friendly API – Customizable pricing models |

9.8 | Processing Fee Applies to Visa, Mastercard,

Discover. 2.75% + $0.30. Interchange + Card Brand Fees + 0.3% + $0.30 ; Amex Processing Fee · 0.3% + $0.30. |

COMPARE |

| 3 | Leaders | – Exceptionally low industry rates – Rapid approvals, often same-day – Unmatched 24/7 customer service |

9.3 | Industry Low Rates — Over 20 years experience,

thousands of businesse |

COMPARE |

| 4 | Merchant One | – Budget-friendly monthly fees – Personal account manager – Wide selection of payment hardware |

9.6 | Get Rates as Low as 0.29%

Get A Free Credit Card Reader Sign Up For Merchant One® Credit Card Processing. PrState-Of-The-Art POS Systems & Payment Terminals Multiple Business Types. |

COMPARE |

| 5 | North Payments | – Minimal processing costs – Flexible, no-contract service plans – Transparent pricing with no hidden fees |

9.4 | Simplify your payments, optimize your business | COMPARE |

| 6 | Payment Cloud | – Instant funding availability – No startup or hidden fees – No strict credit score requirement |

10.0 | PaymentCloud Online Payment

Process Payments Quickly and Easily. |

COMPARE |

| 7 | Square | – Trusted by millions of businesses – Multi-location inventory management – Versatile POS tools for various industries |

9.5 | In person · 2.6% + 10¢ per transaction ;

Online · 2.9% + 30¢ per transaction ; Manually entered · 3.5% + 15¢ per transaction; Invoices · 3.3% + 30¢ per transaction. |

COMPARE |

| 8 | Stax | – Zero markup on processing fees – Fully transparent, no hidden costs – Free first month for new users |

9.7 | Processing up to $150,000 per year: $99/month, $150,000-$250,000

in processing per year: $139/month, $250,000+ in processing per year: $199+/month. |

COMPARE |

Profiles and Reviews of Leading Suppliers

-

Paypal Works for Every Business

Paypal is a trusted source for many merchants today, especially those in the online world. The only thing you need to use Paypal is to add a button to your site.

Paypal is a trusted source for many merchants today, especially those in the online world. The only thing you need to use Paypal is to add a button to your site.

Online stores can be up and running within minutes, and online customers love Paypal. If you are using Paypal in the real world, your equipment will cost you $15 upfront.

Swipe rates for Paypal run at 2.7%. Paypal also offers constant support to business owners.

PayPal is a renowned, trusted company that has been operating for over 20 years. The system enables users to send and receive money from their PayPal accounts in more than 190 countries around the world – making it an ideal alternative when sending cash across borders or abroad as I don't have access myself without first obtaining local currency exchange rates by going through various banks which can take ages.

![]()

-

Square Up With Square

Square is a popular processor to use as it has low fees without a monthly fee. It uses equipment attached to smartphones which just needs a swipe.

Square is a popular processor to use as it has low fees without a monthly fee. It uses equipment attached to smartphones which just needs a swipe.

Fees for Square generally run at 2.75% per swipe or tap and often have no flat fee. It's ideal for small-ticket items such as a coffee or lunch, but not so much for big-ticket items like a new flat-screen TV.

A big plus to Square is it will help give you merchant status quickly, and keeps everything in one place. They also offer business software for payroll, inventory, accounting, emails, and a lot more.

Square or Dharma are considered top choices for restaurants, due to all of these factors. The best credit card processor for a restaurant is something you can bring to the table, and Square offers this, and then some.

Square was created to make it easier for small businesses owners everywhere. Their commitment has never been stronger and they continue on that mission today by offering access-to financing all across America, from side gigs at home or sports stadiums around town.

The Square team believes in empowering entrepreneurs through our tools so they can do what matters most–helping their ventures succeed on their own terms while achieving success the old fashioned way: doing great work you love alongside other passionate professionals who believe just as strongly about making this world better than anyone else does right now.

![]()

-

Payment Depot Has it All

Payment Depot is another very popular system and is good for those big-ticket items or for a business using a large volume of sales. You'll find a membership0-based service here, which means you decide how much you pay, in addition to interchange fees.

Payment Depot is another very popular system and is good for those big-ticket items or for a business using a large volume of sales. You'll find a membership0-based service here, which means you decide how much you pay, in addition to interchange fees.

There is not a percentage markup here, so no matter how much your customer is buying, you will pay what you pay based on your membership. The model here is simple.

The higher your monthly fee, the lower your credit card processing fees, which you will soon see can add up in high volume sales environments.

![]()

-

Shopify

In addition to Paypal, Shopify is a great credit card processing company for online businesses. Many businesses today use Shopify and Paypal concurrently.

In addition to Paypal, Shopify is a great credit card processing company for online businesses. Many businesses today use Shopify and Paypal concurrently.

This is a good system to use if you are just starting. Not only will you be able to accept credit cards, but you can also enjoy a full e-commerce solution through Shopify.

Plans for Shopify start low, as low as $30 and that can include everything from web hosting to credit card processing.

Rates run at approximately 2.9% per online transaction, and slightly lower for in-person transactions. Web hosting costs will be in addition to credit card membership prices, but Shopify also adds a website builder with its line of products.

If you only need a Shopify button on your site, you can get one as low as $9 monthly, but your customers may need a Shopify account to use it. Because so many already have a Paypal account, it's not a bad idea to use both services if the bulk of your sales are online.

![]()

-

Helcim Credit Card Processing

Helcim is a very popular credit card processing company for brick and mortar locations with monthly fees as low as $12.00. If your business brings in at least $2,000 monthly, Helcim is worth the fees.

Helcim is a very popular credit card processing company for brick and mortar locations with monthly fees as low as $12.00. If your business brings in at least $2,000 monthly, Helcim is worth the fees.

All of their price plans are listed clearly on the website, which also has a database of how-to-guides for new business owners.

Merchant Services is the payments company that just keeps on giving. Helcim is relentless in its pursuit to raise the bar and provide a better service for merchants, by making it easier than ever before with an affordable solution. When small business owners are able to get paid more often then we all succeed together as one big happy family.

Helcim is a payment processing and software company that puts the customer first. They built their reputation on trust, transparency, excellent service for over 40 years in North America to help merchants grow their businesses through peace of mind while providing you with cutting-edge solutions tailored just for your needs.

![]()

-

Dharma Offers Sales for Big Sales

Dharma is another big name in the credit card processing business. You'll find upfront fees here, and upfront guidelines from Dharma.

Dharma is another big name in the credit card processing business. You'll find upfront fees here, and upfront guidelines from Dharma.

One thing that Dharma is very upfront about is that if you are a small business, Dharma may not be for you. Sales less than $10,000 monthly would be considered a small bus9iness.

Their rates also aren't on the low end and can be as high as 0.35% per swipe on top of your interchange fees.

![]()

-

Intuit QuickBooks Payments

If you have a business, you have an accounting department, even if that department is your desk at home in the middle of the night. Intuit QuickBooks is a very big name in the accounting world, and thus a great credit card processing system for small business.

If you have a business, you have an accounting department, even if that department is your desk at home in the middle of the night. Intuit QuickBooks is a very big name in the accounting world, and thus a great credit card processing system for small business.

You can use Intuit for both mobile and desktop accounting, and this system will easily integrate with your sales and your accounts receivables.

Intuit also offers a device to plug in your smartphone for swipes, or a fully integrated system that can run in the thousands.

![]()

-

Payline Pays You On Time

Payline Data is another credit card processing company that is good for small business. It offers an interchange plus cost model which will help you to decide how much you pay for your credit card processors.

Payline Data is another credit card processing company that is good for small business. It offers an interchange plus cost model which will help you to decide how much you pay for your credit card processors.

Payline also offers a monthly payment option, and round the clock support for all businesses.

![]()

-

Credit Card Processing

Another popular model today is CreditCardProcessing.com, which is becoming quite popular in the digital era. Here you will find the interchange plus cost model, and this company does not require a cancellation fee.

Another popular model today is CreditCardProcessing.com, which is becoming quite popular in the digital era. Here you will find the interchange plus cost model, and this company does not require a cancellation fee.

Check the fine print before you decide on a free equipment offer, as there may be a monthly sales minimum.

![]()

-

Sam's Club – Clover / First Data

Sam's Club offers Clover, a First Data company which is another popular credit card processor, but it does have a few catches you want to be aware of. They are not as upfront about costs as other companies are, and you may find yourself in a multi-year contract.

Sam's Club offers Clover, a First Data company which is another popular credit card processor, but it does have a few catches you want to be aware of. They are not as upfront about costs as other companies are, and you may find yourself in a multi-year contract.

Sam's Club is very upfront about its pricing on their website, but you do need their equipment and may not know if you will even need a multi-year contract with them. This is still a popular company, but you do need to do your research before settling with them.

![]()

13 More Top Credit Card Processing Companies to Consider

Buying Guide To Credit Processors

If your company requires a credit card processing system, this guide will help you navigate the top payment processing options available to businesses. Understanding how credit card processing works is crucial, given that there are over 14 billion active credit cards globally and an estimated half a million credit card applications daily.

A single credit card transaction involves approximately seven different steps between the cardholder and the completion of the purchase. These steps occur within seconds, but each second carries a cost for business owners. Gaining control over these expenses begins with understanding how the best credit card processing systems operate

Types of Credit Card Payments

The transaction process starts when a cardholder presents their card at a business. The merchant processes the card through a Point of Sale (POS) system, which communicates with the merchant's processing bank. This bank then contacts the cardholder's bank through the card network (Visa, Mastercard, American Express, etc.), which determines whether to approve or decline the transaction. Every stage of this process incurs a cost for the business owner.

Breakdown of Pricing Models

| Pricing Model | How It Works | Typical Rates | Pros | Cons |

|---|---|---|---|---|

| Flat-Rate | – One set rate for all credit card transactions – Fees often differ slightly for in-person vs. online but don’t vary by card type |

– ~2.5% + $0.10 to 3.5% + $0.30 per transaction | – Simple to understand – No add-on fees for PCI compliance or monthly statements – Often includes free POS software and card reader |

– May be more expensive for higher-volume sellers |

| Interchange-Plus | – Provider adds a small markup or monthly fee to the base interchange rate set by card associations – More transparent, itemized |

– Markup: 0.10% + $0.05 to 0.50% + $0.25 per transaction, or – Monthly subscription + ~$0.05–$0.15 per transaction |

– Very transparent – Often the most cost-effective for businesses processing > $5,000 monthly – Can be tailored to different transaction types |

– Interchange rates vary based on card type and other factors – Slightly more complex than flat-rate |

| Tiered | – Rates split into “qualified,” “mid-qualified,” and “non-qualified” tiers based on transaction details – Traditional merchant services model |

– Each tier has different rates; exact costs depend on business volume, industry, and transaction type | – Potentially cost-effective for higher-volume businesses – Useful in certain industries (e.g., wholesalers, multi-store retail) |

– Complex setup and monthly statements – Often requires lengthy contracts with early termination fees – Harder to predict actual costs since transactions are categorized into multiple tiers |

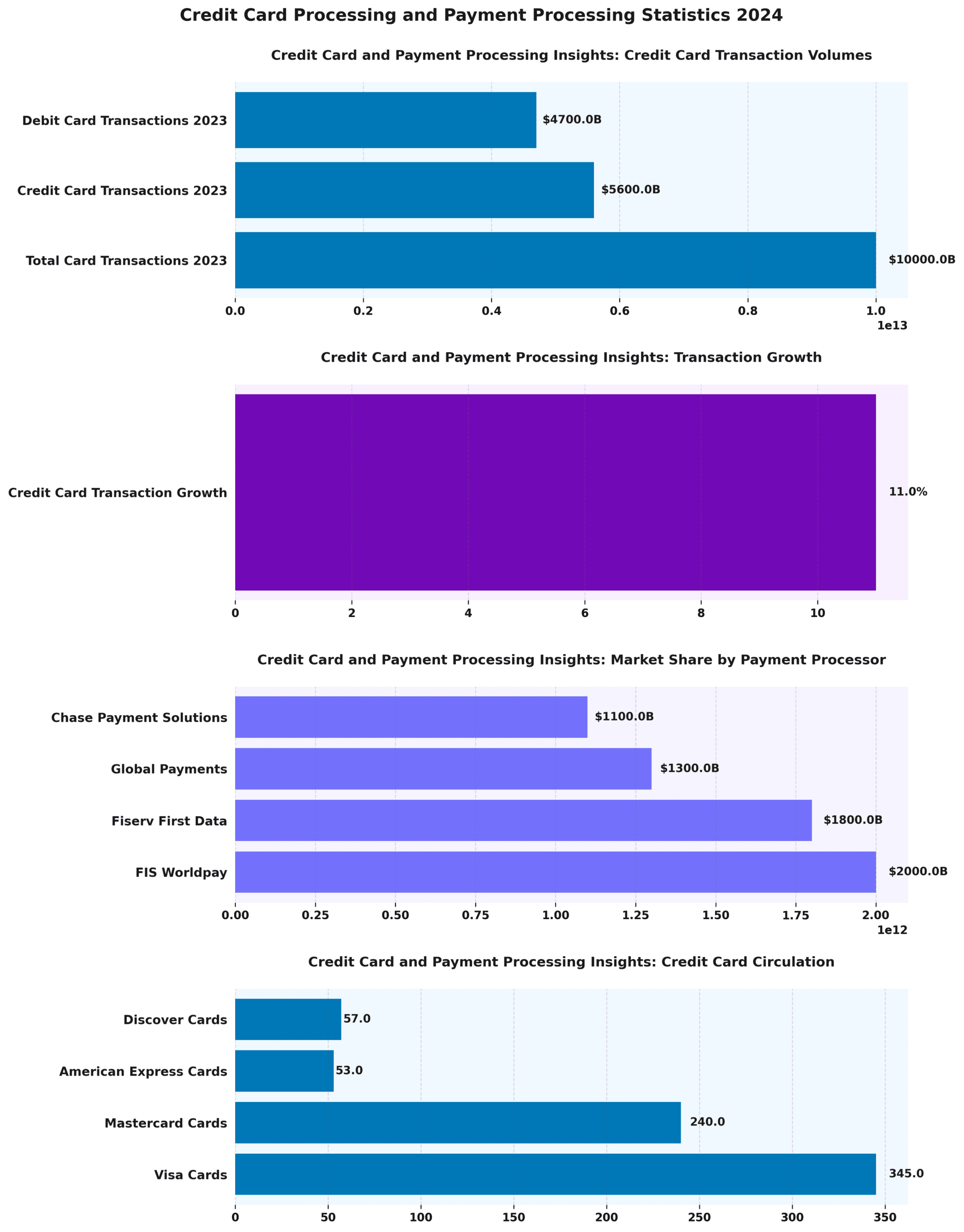

The Credit Card Processing and Payment Processing Statistics 2024 offer a comprehensive overview of the credit card and payment processing landscape, illustrating the financial magnitude of transactions and the competitive dynamics among major payment processors.

Credit Card and Payment Processing Insights highlight significant transaction volumes. In 2023, total card transactions reached a staggering $10 trillion, with credit card transactions accounting for $5.6 trillion and debit card transactions close behind at $4.7 trillion. This distribution underscores the robust use of both credit and debit cards in financial transactions globally.

Transaction Growth data reveals that credit card transactions experienced an impressive 11% growth. This growth suggests increasing consumer confidence in using credit cards, likely driven by the ease and security of digital payments, along with incentives like rewards programs.

- Market Share by Payment Processor: FIS Worldpay leads the payment processor market, handling transactions worth $2 trillion. Fiserv First Data follows with $1.8 trillion, while Global Payments and Chase Payment Solutions manage transactions of $1.3 trillion and $1.1 trillion respectively. These figures highlight the dominance and competitive positioning of these key players in the market.

Credit Card Circulation data reveals Visa as the leader with 345 million cards circulated, followed by Mastercard at 240 million. American Express and Discover have 53 million and 57 million cards in circulation, respectively. Visa and Mastercard's significant lead in circulation suggests their strong brand recognition and widespread acceptance, driving their continuous growth.

The Credit Card Processing and Payment Processing Statistics 2024 illustrate a thriving financial ecosystem with expanding transactions and competitive market dynamics, emphasizing the importance of digital and credit payments in modern economies. As consumer behaviors evolve, these trends are essential for businesses and financial institutions to consider for strategic planning and market positioning.

Cost and Fees

Transaction fees and payment processing rates are the costs businesses incur when accepting credit card payments.

These costs include:

- Interchange fees

- Assessment fees

- Processor markup fees

Understanding these fees is vital because they can impact profit margins and vary between service providers.

Fee transparency is necessary for businesses to avoid hidden charges and choose the best processor.

Security and Fraud Protection

Security and fraud protection are essential for businesses processing credit card payments. This involves using fraud prevention measures, chargeback management, and risk assessment strategies to prevent credit card fraud.

Credit card processors use machine learning algorithms to detect anomalies in transaction patterns in real-time. These processors also employ advanced encryption techniques to protect sensitive customer data.

Chargeback management systems help merchants dispute fraudulent chargebacks and track chargeback ratios.

Implementing these measures enhances customer trust and reduces potential financial losses.

Integration and Compatibility

Integration and compatibility with existing payment processing software and POS systems are critical for selecting a credit card processor.

API integration allows businesses to embed payment processing directly into websites or applications, enhancing user experience and efficiency.

Virtual terminals enable transactions from remote locations, ideal for mobile sales forces and service-oriented businesses.

Understanding integration capabilities ensures smooth operations, influencing transaction speed, accuracy, and customer satisfaction.

COMPARE QUOTESWhat are the Current Fees for Credit Card Processors?

The actual cost of processing credit card transactions depends on the fee structure chosen. Here are the three common types of fees:

- Tiered Rates – Transactions fall into categories like qualified, mid-qualified, or non-qualified, with different pricing for each.

- Flat Rates – A set percentage charged per transaction, making budgeting easier for small businesses.

- Interchange-Plus Pricing – Businesses pay a percentage of each transaction plus a fixed fee.

Features and Benefits of Each

Top credit card processors offer features like 24/7 customer support, fast transaction processing, and diverse payment method acceptance.

Benefits include improved cash flow from quicker transactions and increased trust from secure payment options.

Additional features may include loyalty program integration and customizable reporting, helping businesses tailor solutions to their needs.

How to Choose the Best Credit Card Processor for Your Business

Choosing the best credit card processor requires evaluating fees, integration capabilities, transaction types, and security features.

Consider sales volume, monthly fees, transaction fees, and customer support when selecting a processor.

Best credit card processors should offer seamless integration with existing business systems and ensure data security.

Assessing Your Business Needs

Assessing your business needs involves evaluating transaction types, sales volume, and preferred payment methods to choose a suitable credit card processor.

Understanding transaction limits and payment preferences helps determine affordable processing fees and enhances customer experience.

Tailoring payment options to customer demographics can improve engagement and loyalty.

Comparing Options and Making a Decision

To choose a suitable credit card processor, compare options based on transaction fees, system compatibility, and customer support quality.

Consider the processor's ability to handle multiple payment methods and its security features to protect customer information.

Evaluating these factors ensures the selection of a processor that meets business needs and supports future growth.

COMPARE QUOTESGet your company added to our review. Click Here to be considered as one of our top-rated credit card processing companies.

- Online Credit Card Processing Review

- Compare Card Card Processing Fees

- How Credit Care Processing Works

- Flagship vs Helcim vs National Bankcard vs Cayan

Why Customers Prefer Credit Card Payments

Credit cards offer customers convenience, security, and incentives such as cashback and fraud protection. Businesses that accept credit cards can increase their sales volume significantly by catering to customers who prefer cashless transactions.

Final Thoughts: Selecting the Best Credit Card Processing Service

The right credit card processing system can enhance customer satisfaction, streamline operations, and maximize revenue. Carefully comparing pricing models, security features, customer support, and contract terms will ensure that you choose the best provider for your business.

By offering a secure and reliable payment option, you can attract more customers, increase transaction volume, and grow your business effectively

COMPARE QUOTESOther Merchant Service Fees to Consider:

Statement Fees: All credit card processing companies require some type of statement fee. The average is $8.00 -$10 per month.

Account Clearing: The processing time that it takes from when the customer approves a charge until the time the money actually clears the account. Typical is 1-2 days.

Fraud Protection Services: Specifically look at address verification, SSL (secure socket layer), and CVV2 verification.

Minimum Fees Per Month: The monthly minimum fee which you will be required to meet each and every month to keep the merchant account active.

Related Articles: